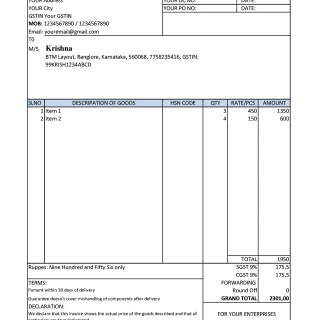

GST Bill Format (Invoice Template with GST Calculation)

A compliant GST bill format is required for businesses registered under the Goods and Services Tax system. This invoice format is designed to meet GST requirements and help you generate clear, tax-compliant bills for your customers.

Our GST invoice template includes all mandatory GST fields and calculations. You can download the template or create a GST-compliant invoice online with automatic tax calculation.

Download GST Bill Format Create GST Invoice Online

What is a GST Bill?

A GST bill (GST invoice) is a tax document issued by a GST-registered business when selling goods or services. It must contain specific details defined by GST law.

- GSTIN of the seller

- GSTIN of the buyer (if applicable)

- Invoice number and date

- HSN or SAC codes

- Taxable value and GST rates

- CGST, SGST, or IGST amounts

What is included in this GST Bill Format?

This GST bill format includes all mandatory elements required under Indian GST regulations:

- Seller and buyer details with GSTIN

- Invoice number and issue date

- Description of goods or services

- HSN / SAC codes

- Taxable amount

- CGST, SGST, and IGST fields

- Total invoice value

The structure follows standard GST invoice rules and is suitable for businesses across India.

How to Create a GST Bill (Step-by-Step)

Step 1. Enter business details

Add your company name, address, and GSTIN.

Step 2. Add customer information

Include customer name, address, and GSTIN if registered.

Step 3. List goods or services

Enter item descriptions along with HSN or SAC codes.

Step 4. Apply GST rates

Specify applicable GST rates and let the system calculate CGST, SGST, or IGST.

Step 5. Generate final invoice

Review the bill and download or export it as a PDF.

GST Bill Format vs Regular Invoice

A GST bill contains additional tax details compared to a standard invoice.

- GST bill: Includes GSTIN, tax breakup, and HSN/SAC codes

- Regular invoice: Does not meet GST compliance requirements

Using the correct GST format helps avoid tax issues and ensures compliance.

Who should use this GST Bill Format?

- GST-registered businesses in India

- Traders, manufacturers, and service providers

- Freelancers required to charge GST

- Companies issuing tax invoices

Download or Create Your GST Bill

Download the GST bill format for free or create a GST-compliant invoice online with automatic tax calculation. No registration required.

Frequently Asked Questions

Is this GST bill format compliant with Indian GST law?

Yes. The template includes all mandatory fields required for GST invoices in India.

Does this GST invoice calculate CGST and SGST automatically?

Yes. When using the online generator, CGST, SGST, or IGST is calculated automatically.

Can I use this GST bill format for services?

Yes. The template supports both goods and services with HSN or SAC codes.

Is this GST bill format free to use?

Yes. It is free for personal and commercial use.

Can I export the GST invoice as PDF?

Yes. You can download or export the final GST invoice as a PDF file.